Acquisition Targets

New acquisitions of interest will most often present value-add potential through asset management or redevelopment and will fit within the following criteria;

Investment value up to £20m

Primarily industrial/warehouse sector, or strategically significant brownfield land

Stand-alone (sub 100,000 sqft) units or multi unit estate

Scope to add value through asset management or redevelopment

West Midlands region

Partners We Work With

Proven track record and ability to co-invest

Project opportunities identified and investigated

Creativity and targeted expertise

Require a funding partner to leverage capabilities

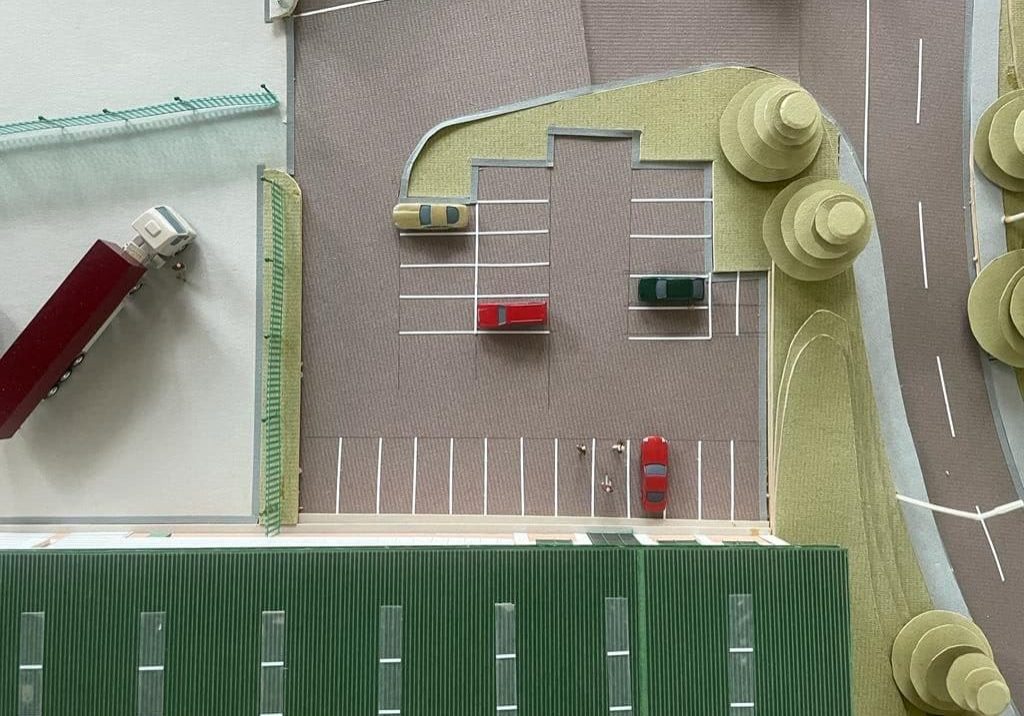

Tame Park Case Study

Utilising a strategic collaboration with multiple partners, we acquired and redeveloped 9 acres of land, culminating in the creation of 6 expansive units totalling 125,000 square feet. Our proficient execution ensured swift construction and leasing, with the entire project completed within a year.